“…when someone buys an NFT, they’re not buying the actual digital artwork; they’re buying a link to it.”

24.09.2021 — NFT, art, ethereum, on-chain, off-chain, storage — 6 min read

First is the physical artwork. This can be digitized and hosted somewhere online. That digital version is minted as an NFT. The NFT is really a certificate of authenticity and provenance and a deed to the digital work as well as the physical original.

Without looking into it, I thought that entire files -anything from 4×4 pixel blocks, 16G videos, 9mb gifs- would be encrypted and stored in a standardized format on the blockchain, with parts of files seeded between Ethereum maintainers much like bittorrent files; In the same way Instagram allows people to upload masses of images, and how Netfix never goes down and seems to host hours of video… “What a large set of virtualized storage containers they’d need to keep this ever-updating, ever-increasing series of artwork, tokens and transactions in the blockchain”, I thought. And, what a large electrical bill it would cause open-source users to maintain such an infrastructure!

I was partially correct in assuming the storage of NFTs was on a network such as BitTorrent. That’s one of the ways digital artifacts can be stored. But, I was totally wrong about how NFTs reference an artwork that it claims to represent.

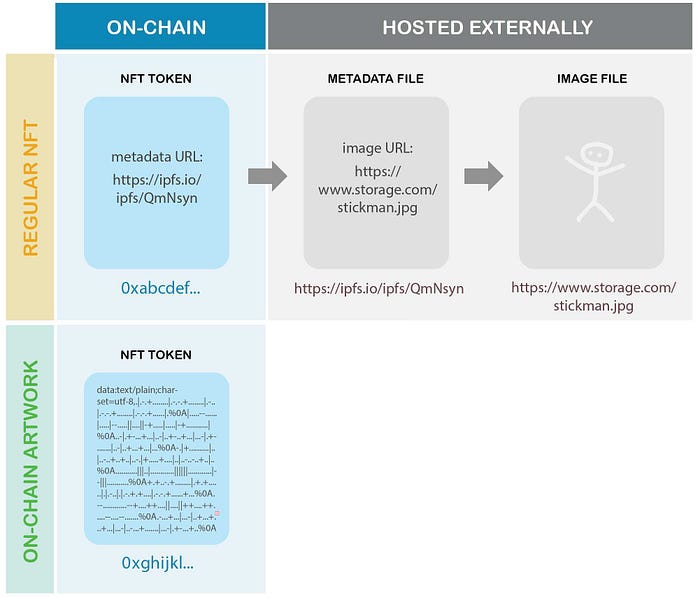

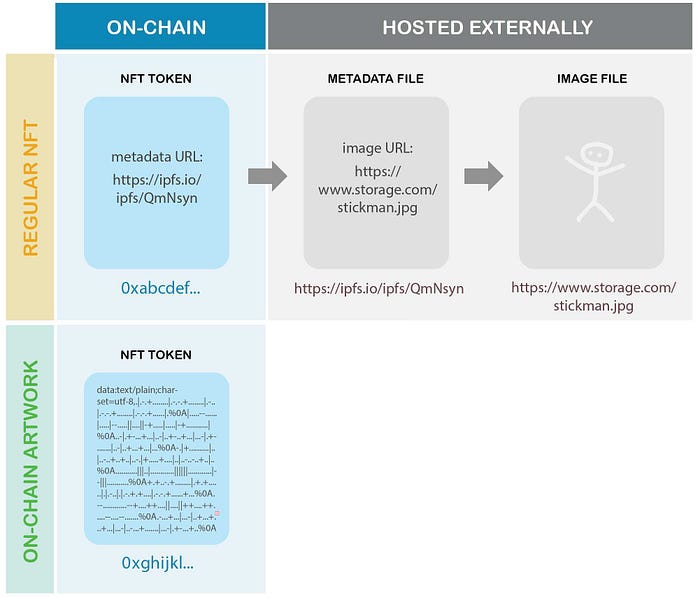

On existing NFT marketplace platforms, such as Bitbrowze.com, there are what’s known as “on-chain” and “off-chain” ways that NFTs reference their relationship to a work of art. These different mechanisms dictate the persistence, permanence, and longevity of an artwork associated with an NFT version of it.

How can an artist guarantee that an artwork will be accessible 5, 10, or 100 years into the future? What are the risks of holding an artwork for a lifetime? Can one reassure art collectors that they’ll be able to pass NFTs on to their loved ones who will inherit the artwork rather than some worthless token pointing to a broken URL?

Rohan Pinto

jboogle, “The broken promises of NFT Art”, 2020. Ibid.

Ibid.

On-chain NFTs

In the on-chain method, information about an artwork (metadata) is embedded in the smart contract. The actual artwork is stored on IPFS (InterPlanetary File System), which works like a peer-to-peer network.2 Platforms like Rarible use conversion services like Pinata or NFT.Storage to create an IPFS object.4 This object contains the information that points to the link of an image, video, or the digital thing of which you wanted to create a NFT. The original file doesn’t exist on the blockchain! 2 3

“…when someone buys an NFT, they’re not buying the actual digital artwork; they’re buying a link to it.”

Anil Dash, “NFTs were not supposed to end like this”, The Atlantic. April 2 2021. 2

IPFS is fine to use if you decide to run your personal IPFS node to maintain your artwork. . Naturall, you’ll foot the cost of the hardware (much like running your own server) and need a constant connection to the internet to maintain availability of your digital file. Alternatively, you must keep pinning the content or pay for the service that keeps pinning it––Services like FileCoin and infinFT bring both decentralized protocols and storage of digital artifacts for persistence and longevity. By this I mean, making the content available to other nodes for them to copy and distribute it in event that your original personal node goes down or that the software on the node tries to clean up any unused data in order to make space for other users 49. Just because you make the artwork readily available doesn’t mean its data is stored and persisted longterm.

Therefore, you have three things to pay for in the process of rolling out your own on-chain NFT:

- the creation of IPFS object with metadata about the artwork – This approach offers the metadata of the NFT token that will POINT to your artwork 4

- the IPFS pinning services (FileCoin and infinFT )– This ensures that the presence of the object pointing to the artwork is available on a regular basis

- the decentralized storage solution – where your artwork actually resides (hopefully forever).

- IPFS is my preferred choice for peer-to-peer, decentralized storage due to 5:

- the ability to identify a file by its contents, (content-addressing)

- the capacity to verify that the artwork data that someone requested is the exact data sought by the user

- the immutability of the artwork’s content

What about the Off-Chain Method?

In the off-chain method, the artwork is likely stored on a centralized server like AWS. In fact, with this method, all the popular options that come to mind might be more stable and performant. (Good luck! JK)

Disadvantage?

Does it matter? Yes it does, says collector diehards.6 7 If the artist is able to swap out the file, it undermines the certainty of what the buyer had paid for! In a bid to show how competitors in the NFT-creation market are selling brittle services, Showcase called out OpenSea, Matic and Editorial for using centralized storage instead of their own means of storage.

Advantage

Anyhow, some of the advantages of “off-chain” measures include using software oracles to allow for the introduction of outside factors (such as news headlines, weather information, performance of the stock market) to the if/else mechanisms of smart contracts. The way smart contracts are talked about at the time of introduction implies that transactions only occur in the vacuum of a decentralized application’s logic. The off-chain method offers an advantage of preventing external factors like stock market crashes and natural disasters (barring the coincidental destruction of storage, internet service, the dapp servers, the murder of the development leadership…) from compromising the security and operation of the blockchain. However, it also makes projects harder to connect with those outside factors. An Oracle software tool is a device that can be associated with determinant events such as the example of a soccer player who scores a hattric. A dynamic NFT would connect to an on-chain process and accommodate this event.

Chainlink’s example of how to integrate oracles creating dynamic blockchain NFTs using Chainlink oracles.

For another example, if you wanted a NFT to become resaleable only if a certain stock performs well, you could use an oracle to connect the blockchain with stockmarket information every few days. This invariably introduces security issues but allows developers to create smart contracts that connect to real world events.

Addressing the generative art perspective, an artistically sympathetic developer, Ricardo Stuven argued that, “When it comes to on-chain artwork NFTs, the token doesn’t just refer to a piece. The token itself is the piece.”8 It does not matter that the work is pointed at or is stored elsewhere, moreso that the generative and procedural potential of an artist can be formally leveraged by the functions within the smart contract to create entirely mutative, unique digital works that are according to him, making him more worthy of being collected. Other engineers beg to differ, identifying logic gaps in the way the Hashmasks project actually performed, not due to their full diligence in binding individual tokens to crytographic hashes but in generating a single combined record of provenance. Adam Eisenmann then called on the community to arrive at consensus over the best way to connect an artwork with its NFT.9

This all sounds like nerd in-fighting but the claims of Dash, Khanan, Showcase and other technologists’ are technically true in regards to off-chain mints.

Summary:

The artwork is not stored on the blockchain, and blockchain is not an optimal choice of tech for storage. 6

The current art market is hedging on NFTs to revolutionize the sales of art. And right now, it’s working because a sizeable population have agreed to participate given the way this system works. It’s extremely unregulated yet. I don’t intend to discourage anyone from using these platforms; just sharing what I’ve discovered so that you can make an informed decision 🙂

Footnotes

1 Rohan Pinto. “On-chain versus Off-chain: The Perpetual Blockhain Governance Debate”, Sept 6, 2019.

2 In his now archived Atlantic article, Dash took issue with the way NFTs today establish its relationship with digital artwork. He was an early proponent of such a transparent system for establishing provenance of digital art. In 2014, he and artist Kevin McCoy created a proof-of-concept that was similar to the on-chain method today, but cautioned that technology had not advanced enough yet to store works larger than 4mb on the blockchain. They called it a Monegraph. See: “Seven on Seven 2014: Kevin McCoy & Anil Dash”.

3 “Recently, an NFT-skeptical programmer named Jonty Wareing wrote an in-depth thread on Twitter delving into where the media referenced by NFTs actually lives. He discovered that typically, the token will point off-chain to either an HTTP URL metadata file or an IPFS hash.”

Dan Kahan. “Do You Really* Own Your NFT? Chances Are, You Don’t” The Defiant, Mar 31, 2021

4 IPFS. “What is IPFS?” Jun 22, 2021. IPFS. “Persistence, Permanence, and Pinning”, Jul. 28, 2021.

5 IPFS. “How IPFS Deals With Files – IPFS Camp Workshop”, Sep 17, 2019

6 “On-chain metadata makes an NFT more valuable, in part because the metadata is incorporated into the token, allowing the NFT to last forever (or as long as Ethereum exists), and in part because on-chain tokens have to meet certain Ethereum standards, giving them a liquidity premium and making trading easier. When determining whether the NFT is on-chain or off-chain, the key question is where the NFT is hosted.”

Haug and Partners. “Valuation of NFTs: Factors to Consider and an Alternative to Destroying the Original Work” July 28, 2021.

7 An assortment of technical discussions on StackExchange about off-chain NFTs: StackExchange. “On-chain vs. Off-chain NFT Art Platforms” Ethereum.

StackExchange. “If crypto art is stored off-chain, how does the collector have any control over their NFT’s contents if the server where it is saved shuts down?” Ethereum.

StackExchange. “Can we mint 5 gigabyte video NFTs?” Ethereum.

8 Ricardo Stuven. “On-Chain Artwork NFTs” Treum, Medium. Jan 29 2021

9 Adam Eisenman. “Ethereum NFT token-to-asset mappings are off-chain and nobody cares” CoinMonks. Medium. Feb 21, 2021

Ibid.

Ibid.